How Much Tax Does US Bitcoin Miners Have To Pay?

The recent years have been the era of Bitcoin boomers, where values surged and investors got some big profits this year. Despite its environmental concerns, the United States of America has wildly participated in investing and mining activities and taxes have now been imposed on its value. The tax imposition on your crypto transactions now may affect your business model or your annual bill settlements. This has been far so reinstated since China banned the industry in 2021.

Since then, there has been a rush of miners with a groundbreaking track

price of USD 68,000, as recorded in November 2021. Additionally, the pre-mining

factor before the initial Coin Offering has hastened the process to a major

extent. As the situation may be, Bitcoin and Ethereum are subjected to capital

gains tax rules and all crypto-currency are treated as capital assets, owing to

the government a certain amount of tax, when you sell it at a profit. This

article sheds light on the rudimentary process of Bitcoin mining, how you may

be taxed, costs, profits, and the energy usage and risks.

Evolution of Bitcoin

Ever

since Bitcoin has been launched in 2009, the volatility of prices has never

been an issue with investors. Despite the risks, digital currency was always a

popular choice determining the fate of 69.9% of US citizens, mainly

concentrating around New York, Texas, Kentucky, and Georgia. Interestingly

enough, Bitcoin was soon introduced in the regulations of the US and European

markets, and slowly took over the logbooks of MNCs like Tesla, Overstock.

Considering the success of the last year, we see new Dogecoin and voices of

Elon Musk taking over the internet. Companies like Foundry USA, Riot

Blockchain, Genesis also expanded their facilities, with Genesis heading over

to Iceland and Riot Blockchain expanding its Texas facility. With such

expansive progress, the country has now overtaken China to share one of the

largest Bitcoin mining data.

Bitcoin Basics

The

operation of Bitcoin largely depends on Blockchain technology, which is an electronic

ledger with an increased capacity to store data as the investor list grows. The

blocks in the chain act like compartments where the transaction data are

stored. Each block further contains a unique 64-digit hexadecimal value

outlining the contents of the stored data as well as that of the previous one.

Much like the excitement of Las Vegas casinos, the miner has to guess the hash

value to win a block in the cryptocurrency. The computing power is deployed by

the technology increases as the number of miners begins to increase. But, by

doing so, each miner’s chance loses its chance of winning the guessing game,

making the odds one in one billion. The biggest controversy revolving around

the Blockchain is the absence of a regulation institution like a bank, which

facilitates the PoW or the consensus mechanism of the technology. PoW is

essentially an algorithm that is similar to millions of users mining the

currency, thus, maintaining a strapping way to secure a decentralized network

and ensuring security to its investors.

Ethereum on the other hand, works on a slightly different nudge, with what is called the Proof of Stake or PoS. the biggest advantage which has contributed directly to the rising popularity of this currency, is the absence of the decentralized network of miners, making it far more cost-effective and also slightly eco-friendly than others. Having utilized less energy, this is ideal for future Blockchain miners who work on Smart Contract applications and with non-fungible tokens.

However, the evolution of Bitcoin also bought in a few drawbacks, the

most common of which is cutting rewards by half from 7.25 BTC to almost 3.125

BTC in 2024. But in spite of the drastic change, the ban put forward by China

instigated the spiraling of “Hashrates” to 17.5 quintillion hashes per second.

No wonder the tax departments felt the keen desire to impose a tax on the

profits!

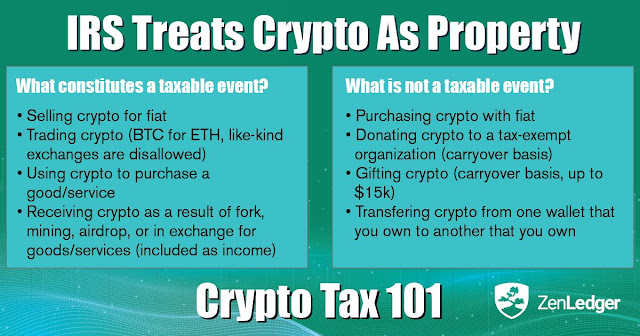

How are the taxes imposed?

The

capital gain taxes depend on how long you have a cryptocurrency and whether you

have mined it as a hobby an individual or as a part of a business entity. If

you have only involved yourself in less than twelve months, then your profits

are taxed at the rates of short-term capital gains, which is the same as your

regular income tax rate. However, if you have been holding the Bitcoin for more

than a year, you will be categorized into long-term capital gains, making your

income tax lower than the former. Much like other investments, crypto also lets

you claim a capital loss if you were unable to make any profits or sold at a

loss. When used with purchases, Bitcoin is also applicable to taxes, as it

counts as the sale of the currency. On top of this, the purchase as per all

laws also requires you to pay sales tax.

With

most miners, it is also categorized as a part of your regular tax income. You

are assigned to pay tax on the entire fair market value of Bitcoin or Ethereum

on the day you received it, as per the regular income tax rate. In case, you

have earned profits while mining the currency, you also pay capital gain taxes

on the profits, depending on the duration of your investments and the profit

generated during the term. Considering the scenarios of unending taxes, you

might want to consider keeping a record of all your transactions, so as to have

an easy time while filling the income tax.

Bitcoin Mining Risks

Every

investment involving monetary transactions has its share of risks. The price

volatility along with potential factors such as internet connectivity,

available electricity sources that should be reliable, overeating of the ASICs

and not to mention system hacks is what revolves around you as a miner.

Investing in an efficient Bitcoin system setup is recommended which regular

servicing of the electrical systems and ensuring sound cyber security of your

operations.

Although

many companies around New York and Texas have expanded their facilities, the

question still arises with the vulnerability of their power grids. Despite the

tax rules, the regulatory policies still pose a challenge. Even Kazakhstan, the

largest country of Bitcoin miners has assimilated new operational procedures to

oversee the high demand of their power grids. In the US, the federal government

is aiming to get significant control of the platform by 2023 and has also urged

the Federal Reserve to look into the risk factors underlying the booming

business.

Climate

change and reducing carbon footprint has taken precedence in recent years and

it is needless to say that Bitcoins have been in the limelight. In a response

to the rising environmental concern, Tesla, one of the biggest Bitcoin

investors recently announced that it would further suspend any purchase due to

various environmental factors. The response from the crypto industry has been

welcoming as well. Many of the long-running companies with large facilities

have been transitioning to renewable sources. Companies such as Lancium, and

HIVE operate on 100% renewable sources of energy with high and efficient

storage. It has been estimated that 40% of US companies so far have made the transition,

with the rest still underway for the change.

Comments

Post a Comment